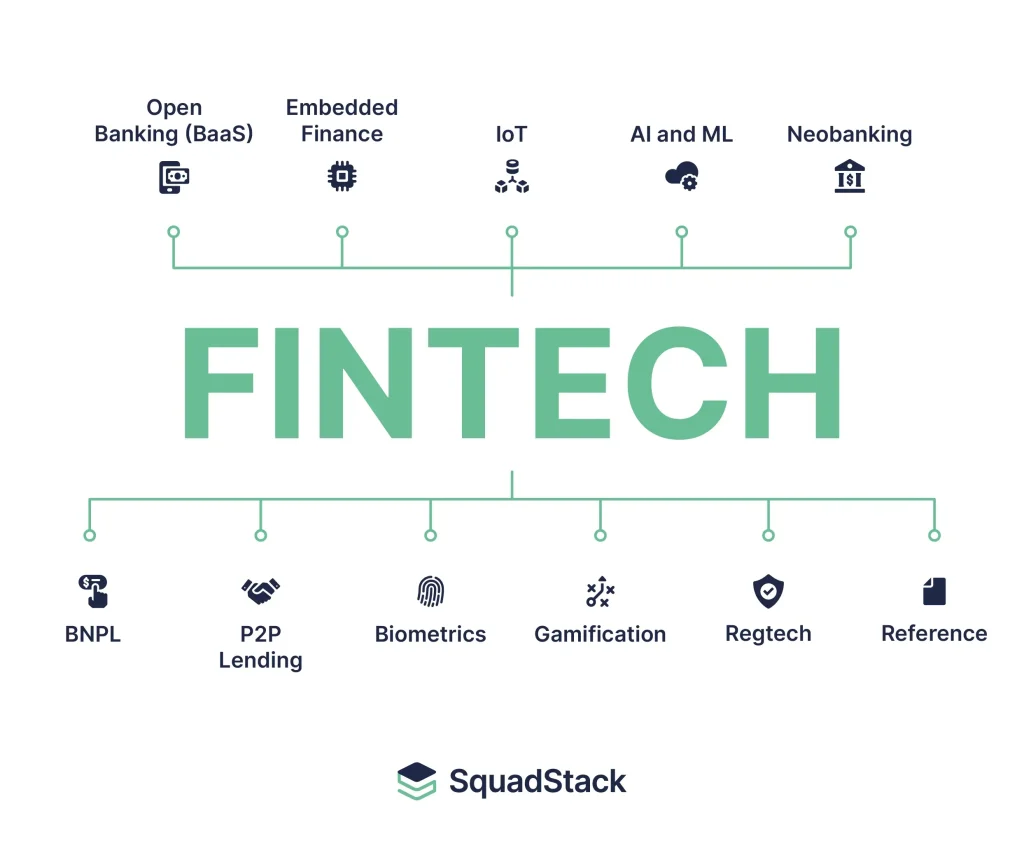

Fintech Trends are reshaping how banks design, deliver, and scale financial services, turning technology into a core strategic driver. As digital transformation in finance accelerates, institutions blend traditional strengths with modern tools to offer faster, safer, and more personalized experiences. Open banking and API ecosystems enable collaborative innovation, while AI in finance powers better credit decisions, fraud detection, and customer insights. Digital payments trends and real-time settlement keep commerce seamless, expanding inclusion and accelerating wallet-based experiences. Whether a legacy bank or a nimble fintech, the focus is on adopting modular, cloud-native platforms that support scalable fintech adoption in banking and resilient operations.

Viewed through an alternative lens, the same movement can be described as digital finance modernization driven by technology-enabled ecosystems. Terms like fintech ecosystem expansion, embedded finance, and API-enabled collaboration signal the same shift toward smarter products and better customer outcomes. We also see data-driven decisioning, cloud-native architectures, and automated compliance as key pillars that support scalable innovation. Together, these LSI-aligned concepts explain why financial services are becoming more accessible, resilient, and intelligent across channels.

Fintech Trends and the Digital Transformation in Finance

Fintech Trends represent more than isolated innovations; they signal a platform-based shift where technology accelerates value delivery across the financial value chain. This new paradigm fuels the digital transformation in finance by weaving open banking and API ecosystems into product design, enabling faster time-to-market, improved risk analytics, and richer customer journeys. AI in finance underpins credit scoring, fraud detection, and tailored recommendations, turning vast data into actionable insights. At the same time, digital payments trends push transactions to real-time, frictionless experiences, expanding inclusion and convenience.

These shifts alter the competitive landscape for banks and fintechs, as the focus moves from siloed features to modular, interoperable capabilities. The journey toward fintech adoption in banking requires robust data governance, secure APIs, and cloud-native platforms that scale with demand while meeting regulatory requirements. By embracing this approach, institutions can deliver personalized experiences, faster onboarding, and resilient operations—achieving growth through collaboration rather than disruption.

Open Banking, AI, and the Future of Banking: Leveraging Fintech Trends for Adoption

Open banking and API ecosystems enable secure data sharing and cross-ecosystem collaboration that powers new products and services. Customers gain choice and control as lenders, payment providers, and financial apps assemble a connected suite of solutions. This open approach is a key lever in the digital transformation in finance, enabling real-time payments, smarter risk assessment, and personalized journeys powered by AI in finance.

To realize the benefits, organizations should chart a pragmatic path for fintech adoption in banking that balances experimentation with governance. Prioritize AI-driven insights to optimize pricing, fraud prevention, and customer support, while deploying digital payments trends securely across channels. Emphasize embedded finance, modular architecture, and API-first development to accelerate time-to-value and support compliant, scalable growth.

Frequently Asked Questions

What Fintech Trends are shaping digital transformation in finance, and how do open banking and API ecosystems enable faster, more secure financial services?

Fintech Trends such as digital transformation in finance, open banking and API ecosystems, AI in finance, and cloud-native platforms are reshaping how services are designed and delivered. Open banking and API ecosystems enable secure data sharing, faster product development, and seamless integration across providers, improving speed-to-market and choice for customers. AI in finance enhances credit decisions, fraud detection, and personalized experiences, while governance and cloud readiness ensure security and scalability.

How do AI in finance and digital payments trends influence fintech adoption in banking and customer experience?

AI in finance and digital payments trends are central to fintech adoption in banking. AI powers credit scoring, risk management, fraud detection, and personalized advice, improving outcomes for customers and institutions. Digital payments trends enable real-time settlement, wallets, and convenient checkout, expanding inclusion and loyalty. To scale these trends, banks should pursue modular, cloud-native architectures, strong data governance, and open APIs for ecosystem collaboration.

| Trend | Key Points |

|---|---|

| Open Banking, APIs, and Ecosystem Power | Open banking and robust API ecosystems enable secure data sharing and seamless integration across services. Banks expose standardized interfaces that fintechs can leverage to offer faster payments, personalized lending, or automated savings. For customers, this translates into more choice and a frictionless experience—without sacrificing privacy or control over their data. Institutions adopting open APIs can accelerate product development, improve time-to-market, and create a more resilient architecture capable of supporting future fintech trends. |

| AI and Data-Driven Personalization | AI in finance is a standard component of modern product design. ML models power credit decisions, personalized advisory services, fraud detection, and pricing optimization. Data analytics helps organizations understand customer behavior and tailor journeys. Effective use of AI augments human judgment, reduces risk, and improves satisfaction. |

| Digital Payments, Real-Time Settlement, and Wallet Innovation | Digital payments have moved from convenience to expectation, with real-time settlement, instant refunds, and contactless transactions. Wallets, QR codes, and embedded payments enable seamless checkout. New rails—including instant cross-border transfers—expand reach. The emphasis for fintech trends is speed, reliability, and security. |

| Cloud Adoption and Scalable Platform Architectures | Cloud-native approaches provide the scale to deploy services quickly and securely. Cloud-based architectures support CI/CD, cost optimization, and resilience. They enable data modernization, improved analytics, and faster experimentation while meeting regulatory requirements when properly governed. |

| RegTech, Compliance, and Cyber Resilience | Governance tools automate monitoring, reporting, and risk assessment to stay compliant across jurisdictions. Cybersecurity remains critical, focusing on data protection, identity verification, and fraud prevention. Emphasis is on proactive risk management, real-time monitoring, and incident response to minimize impact and maintain trust. |

| Blockchain, Tokenization, and Digital Assets | Blockchain and tokenization enable new settlement forms, asset tokenization, and cross-border transactions. Not every institution needs a crypto-native strategy, but distributed ledgers and smart contracts can streamline custody, settlement, and transparency. This shapes asset management, liquidity, and regulatory reporting in a digital era. |

| Embedded Finance and Customer-Centric Ecosystems | Embedded finance places financial services inside non-financial platforms, from e-commerce to software tools. It expands access by offering lending, insurance, or payments at the moment customers need them. It creates new revenue models and strengthens relationships by integrating financial experiences into everyday workflows. |

Summary

Conclusion